Dynamic Taxation Configuration Module¶

Requirement Overview

This document outlines the process flow for dynamic tax calculations. The taxation system is designed to manage multiple tax rates, which may vary from product to product. It allows users to define and configure tax rates within the system

Database Requirement

UI Design

https://www.figma.com/design/q1FcIc4GRxLRLeGbpivFKg/Tax?node-id=365-1660&t=nkLLj0jFiDTqdxpq-1

Functional Requirement

Requirement 1: Tax RateA tax rate is the percentage value applied to the price of inventory items.

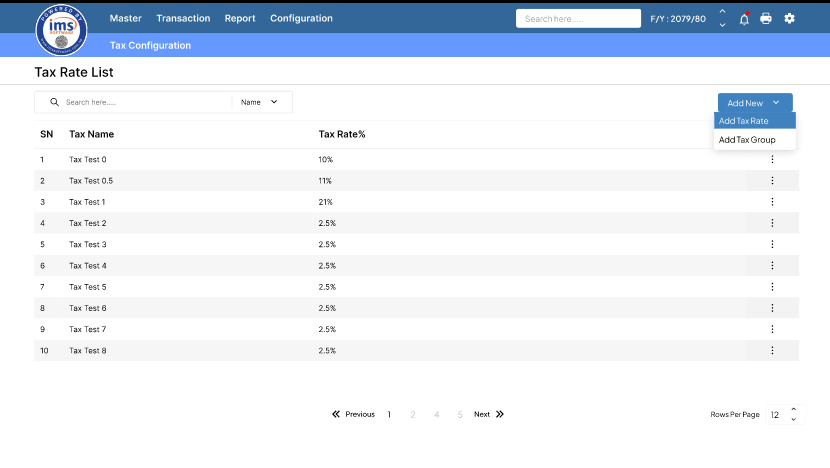

- Create a Tax Rate List displaying all tax rates configured in the software, allowing users to search by Tax Name or Rate.

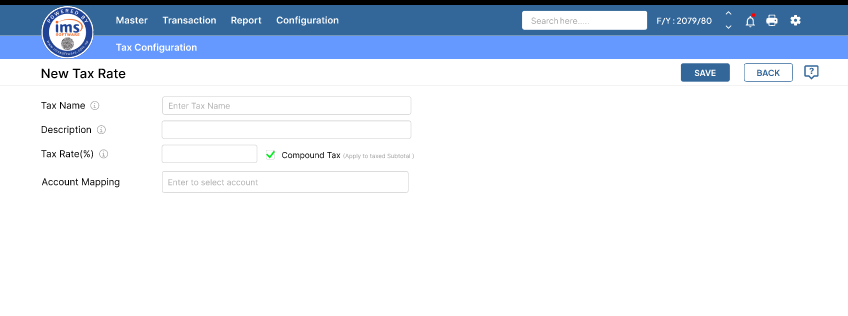

- Click "Add New" to add either a Tax Rate or a Tax Group within the same UI. If the user selects Tax Rate, the New Tax Rate interface will open, where they must enter the following details:

- Tax Name: The name of the tax rate to be created (mandatory field).

- Description: A brief description of the tax rate (optional field).

- Tax Rate (%): The percentage value of the tax applied.

- Compound Tax: A checkbox to apply tax on already taxed amounts. It is ticked by default, but the user can enable or disable it as needed.

- Account Mapping: Press Enter to select the associated account for the tax (mandatory field).

- Clicking on Save will stored the data in table name.

A Tax Group is a collection of multiple tax rates combined into a single entity for easier application to inventory items.

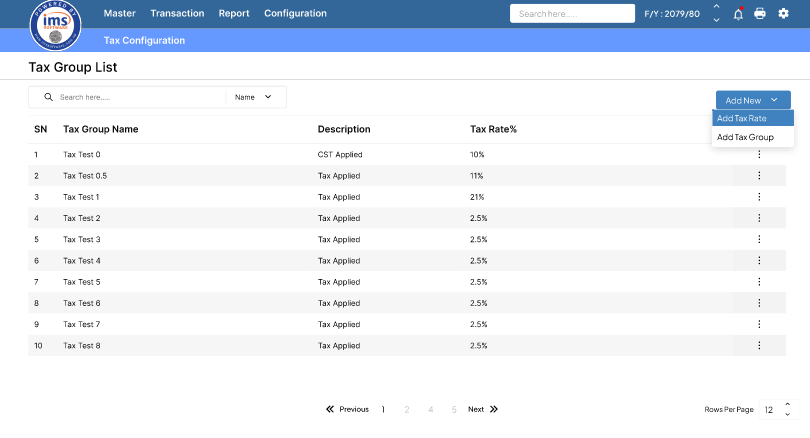

- Create a Tax Group List displaying all configured tax groups in the software, allowing users to search by Tax Group Name, Description, or Tax Rate (%).

Note: The tax rate in the Tax Group List will be displayed after totaling the selected tax rates.

- Click "Add New" to add a Tax Group. Users can also add a Tax Rate from the same UI. When the user clicks "Add Tax Group," the following interface will open:

- Tax Name: The name of the tax group to be created (mandatory field).

- Description: A brief description of the tax group (optional field).

- Associated Taxes: A list of all existing tax rates, where users can select the required taxes. The selected taxes will be applied in the specified order. User can drag to reorder the taxes.

- Click on the Save will stored the data in table_name.

To map the tax group or tax rate to a product.

- Create a P-Tax Group and S-Tax Group in the Product Master as shown in the UI below, where users can select the purchase tax for the P-Tax Group and the sales tax for the S-Tax Group from dropdown.

- The tax rate will be populated in the Sales Voucher and Purchase Voucher as per the selected tax group or rate.