Steps To Create And Manage The Mixed Purchase Transaction¶

A mixed purchase is when trading and non-trading items are purchased together in one invoice.It includes goods for resale and items for business use in the same purchase.¶

Steps to generate Mixed Purchase Transaction:¶

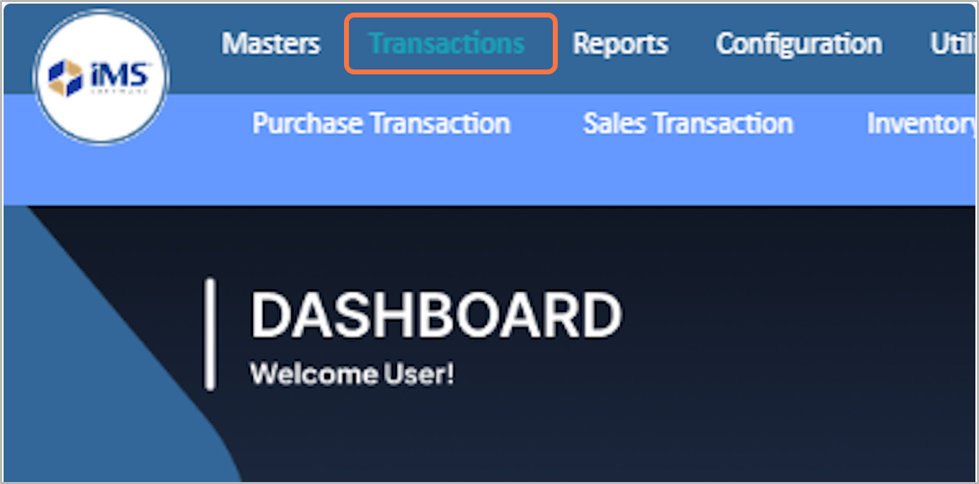

1. Go to the "Transaction" menu.¶

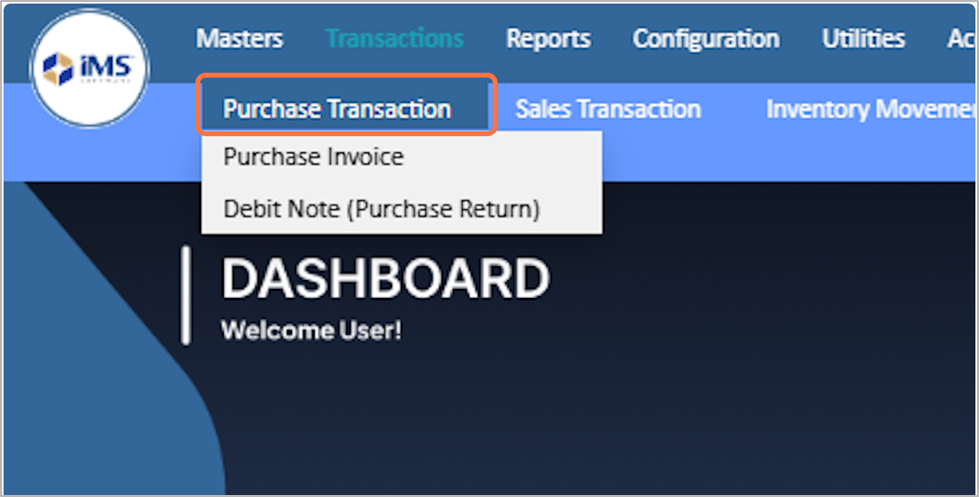

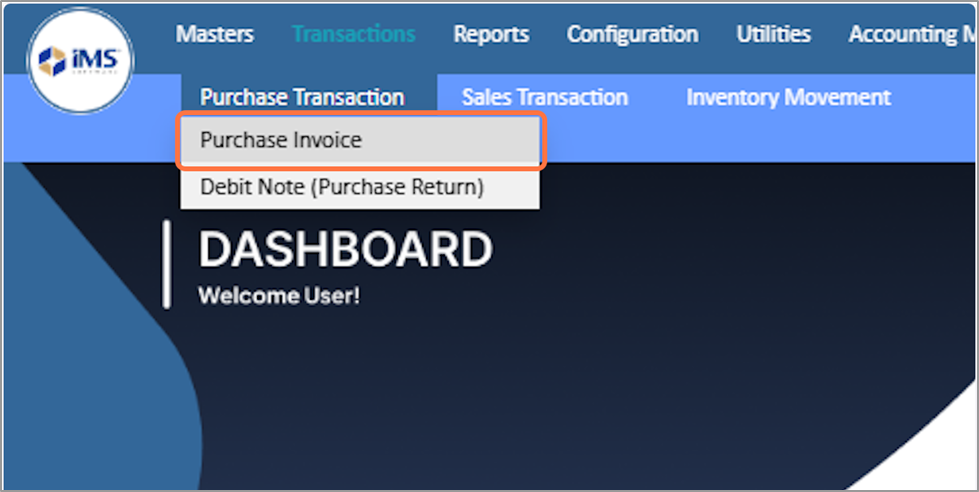

2. Click on Purchase Transaction from the Transactions menu¶

3. Choose Purchase Invoice from the dropdown options¶

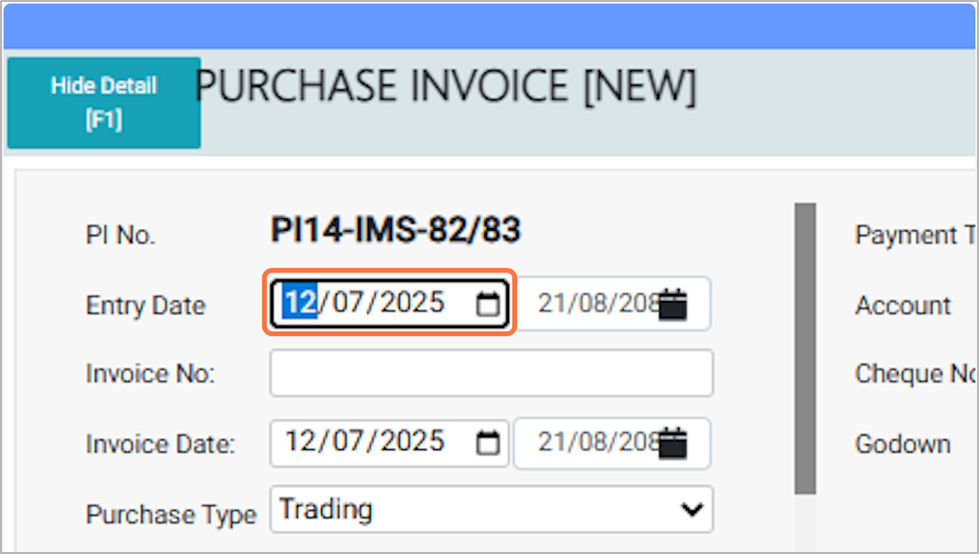

4. Enter the Entry date:

The Purchase Entry Date is the date of the purchase invoice entry, which can be edited as needed; backdating is allowed but future dates are not. Eg: 2025-12-07¶

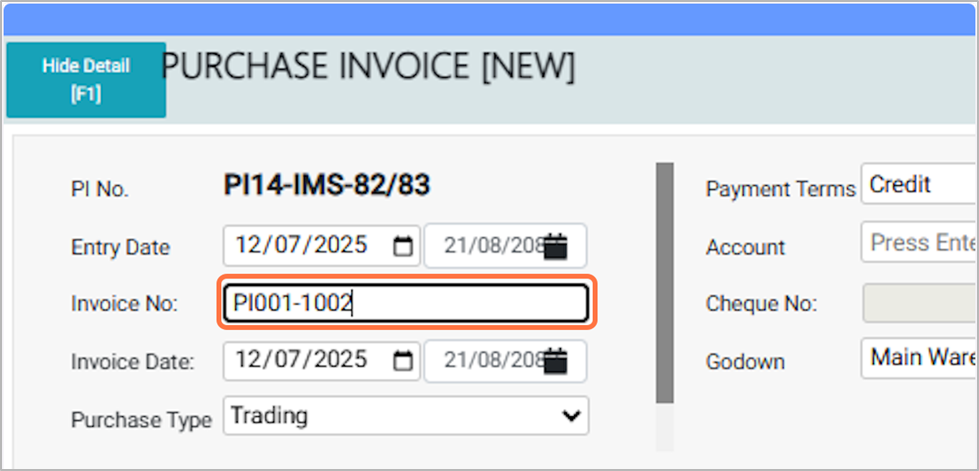

5. Enter the invoice number

Eg: PI001-1002¶

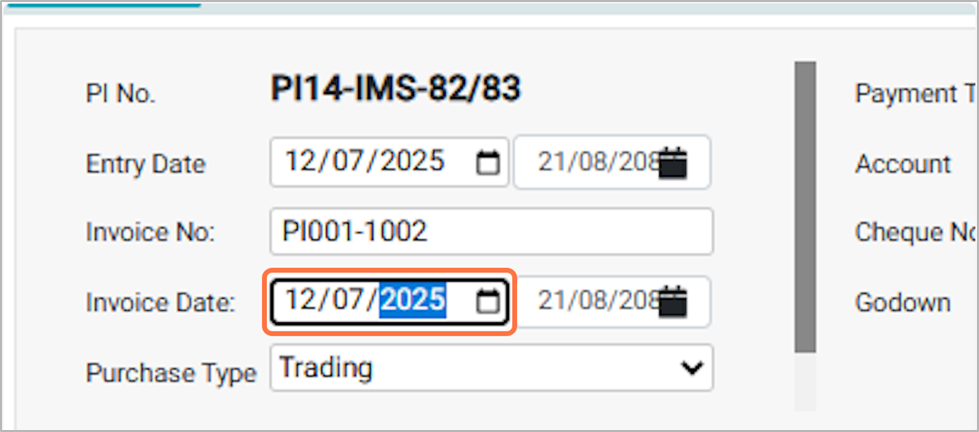

6. Choose the Invoice Date

This is the official billing date of the Purchase. Choose the invoice date, This is the official billing date of the purchase invoice as mentioned on the supplier’s invoice.E.g: 2025-12-07¶

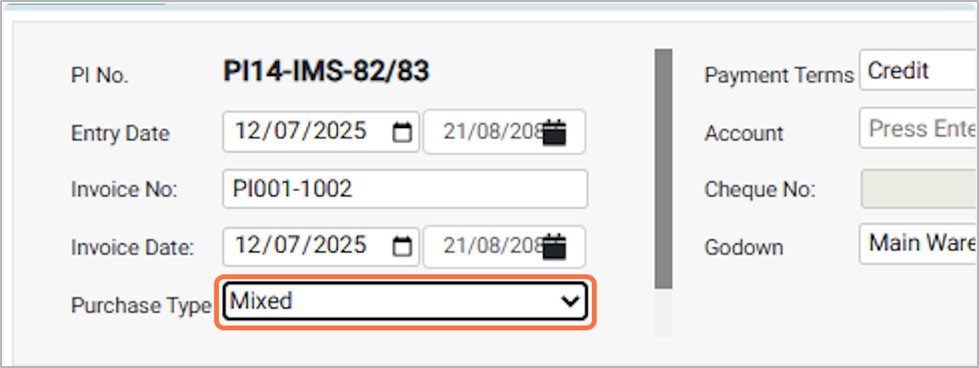

7. Choose the Purchase Type From the available option

● Trading: Select this option if you are purchasing goods intended for resale to customers. These are inventory items bought to sell for profit.

● Non-Trading: Select this option if you are purchasing goods or services not intended for resale, such as office supplies, assets, or services used for business operations.

● Mixed: Select this voucher type when a single purchase invoice contains both trading (resale) and non-trading (expenses or assets) items. This allows you to record all items together in the same voucher.

● For now, we will select the Purchase type as Mixed¶

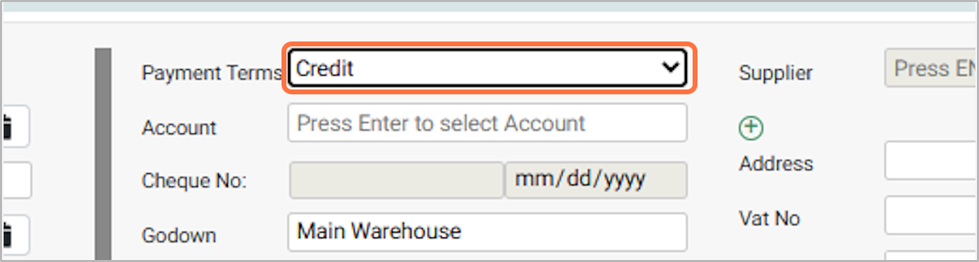

8. Select payment term options.

● Credit: Choose this if the purchase is made on credit.

● Cash: Select this if the purchase is paid in cash.

● Cheque: Choose this if the payment is made through cheque.

● Other: Select this for any other type of payment Method

● For now we will select Credit as Payment terms.¶

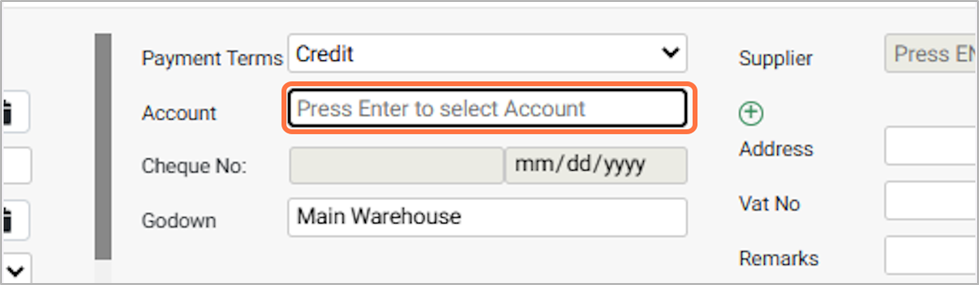

9. Click and Choose the Account:¶

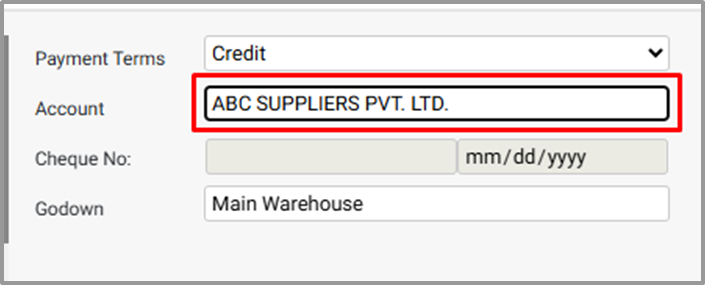

10. Select or search the customer account as mentioned in the purchase invoice,Eg: ABC SUPPLIERS PVT. LTD.¶

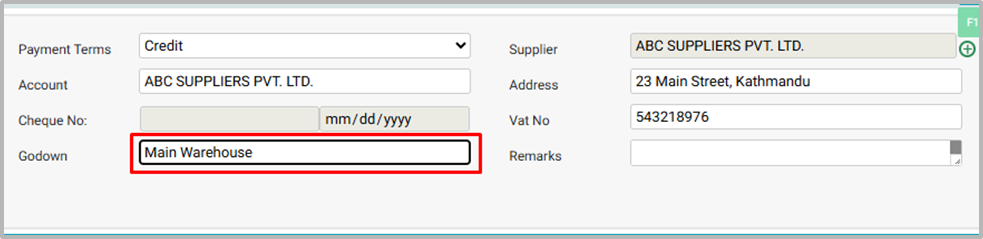

11. Choose the warehouse or storage location where the purchased items will be stored. Eg: Main warehouse¶

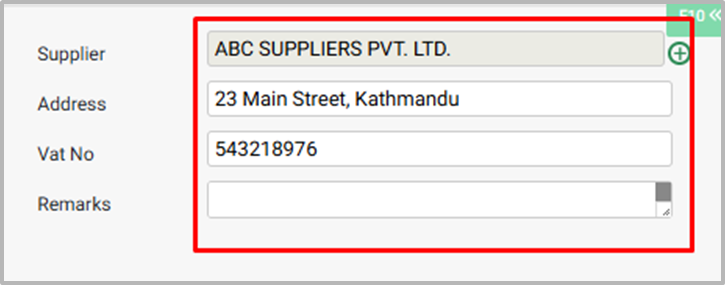

12. Supplier Details Field:

● Case 1:

If you select Credit, Cheque, or Other as the “payment terms”, enter the “Account” as supplier, and the “Supplier details” will be auto-filled.

● Case 2:

If you select Cash as the “payment terms”, the Account will be auto-filled as “Cash in Hand”, but you need to manually select the “supplier”.

● Add Remarks: Enter any additional notes or comments about the purchase as needed.¶

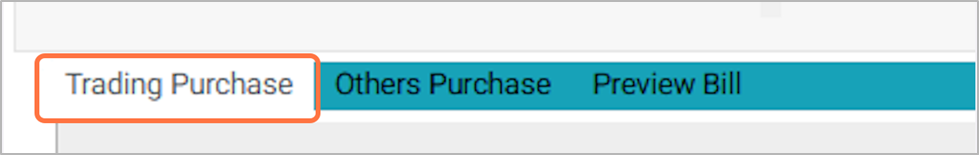

13. Click on Trading Purchase¶

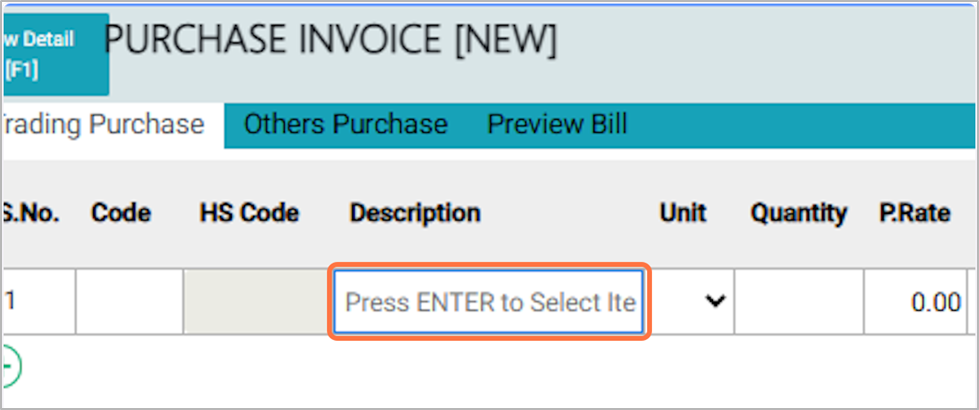

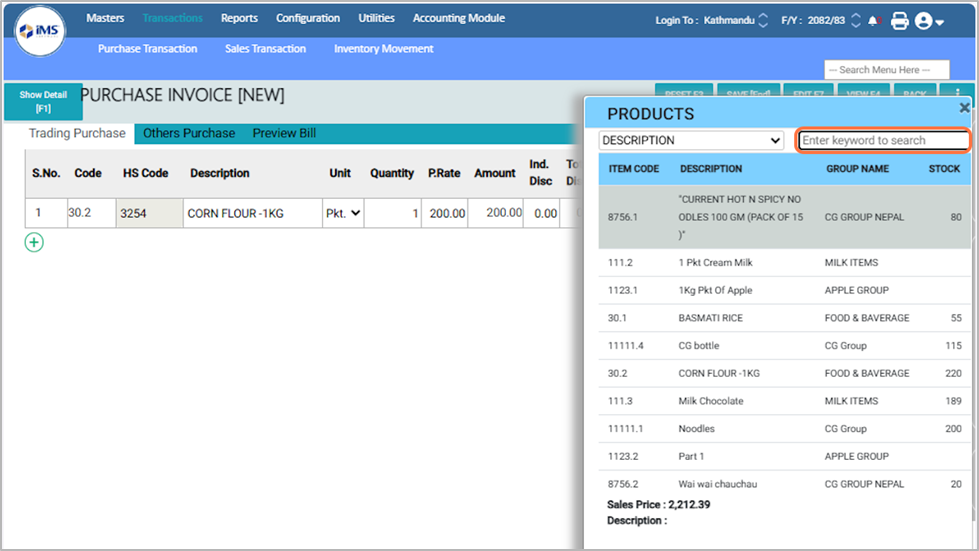

14. Click Enter in this field and select the product you want to purchase.¶

15. Search or Select the product you want to purchase from the pop up list,

Eg: Cornflour – 1 KG.¶

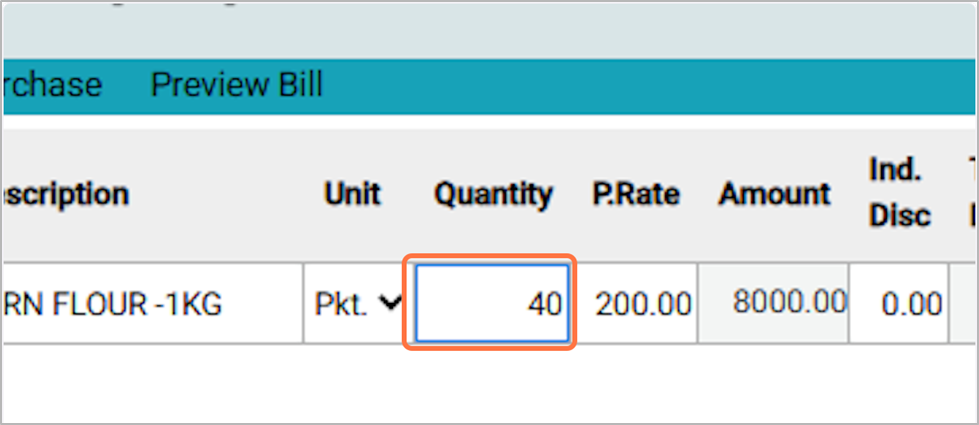

16. Enter the number or quantity of the product you want to purchase.

Eg: 40¶

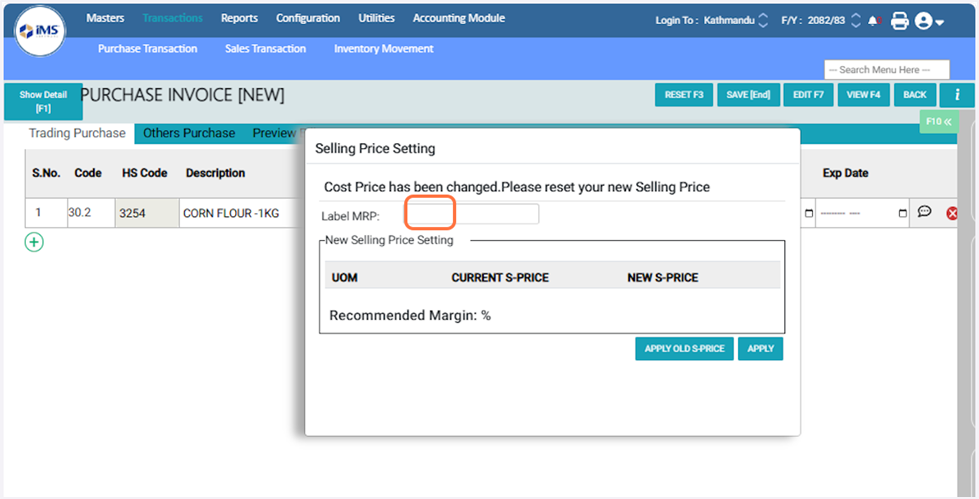

17. To change the selling price, in open the pop-up, enter the new rate in the MRP Level field, and click Apply. The new price will be applied to the purchase.Example: 200¶

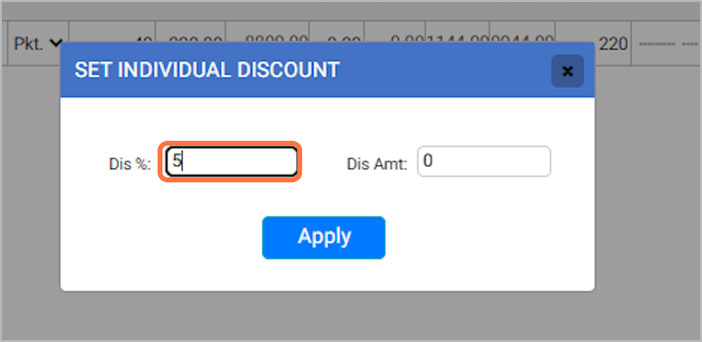

18. To give a discount on the purchase, click on the Discount field, enter the discount either in percentage or amount, and click Apply.Example: 5¶

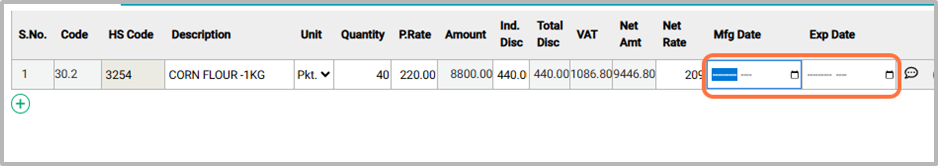

19. If the purchased product is expiry-tracked, enter the Manufacturing (MFG) date and Expiry (EXP) date for the product.¶

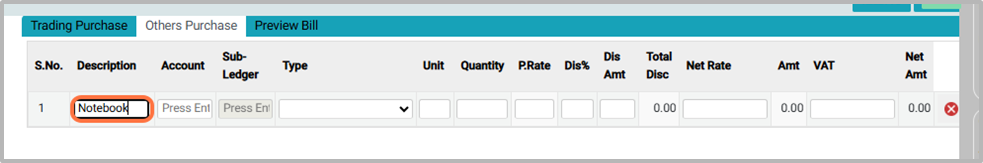

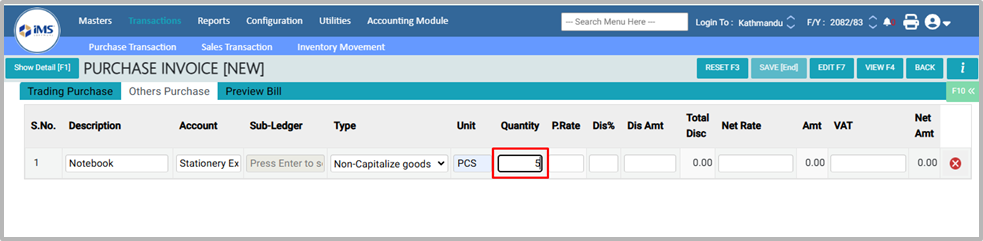

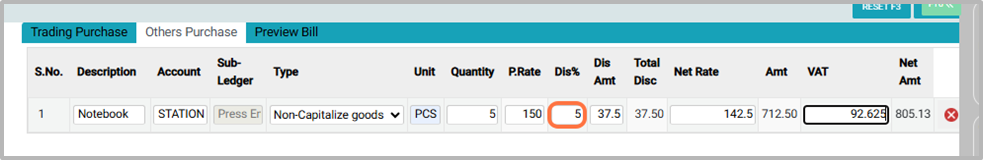

20.Click on "Other Purchases" for non-trading transactions.¶

21. Enter a description and name of the Product. Eg: Notebook¶

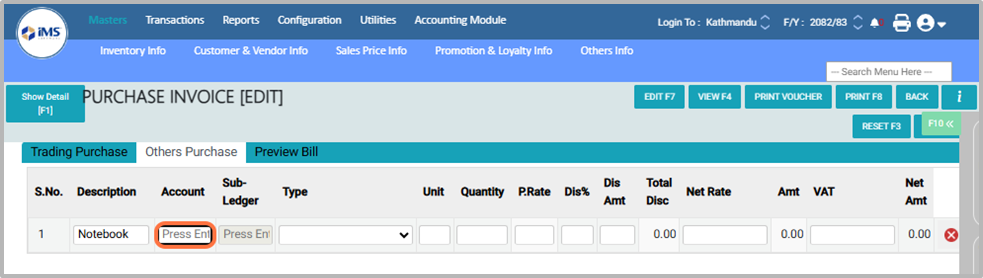

22. Select Account:

● Choose the account that is mapped with a ledger in the Account section. This determines where the purchase will be recorded in your financial records.Examples:

• For laptops, select the Machinery Account.

• For other non-trading items, select the appropriate account based on the type of expense or asset.

• For notebooks, select Stationery, as this ledger already exists in the Account section.¶

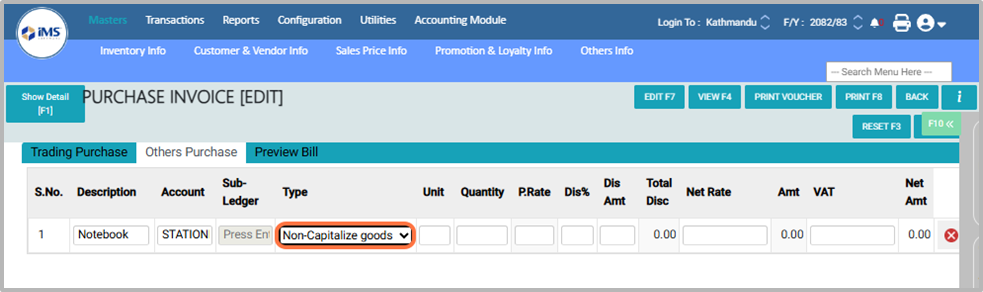

23. Select Non-Trading Purchase Type:

● Choose the appropriate non-trading purchase type. Select Capitalize Goods for assets such as laptops or other items that are recorded as fixed assets and reused in the future. Select Non-Capitalize for one-time usable items like office stationery (pens, Notebooks, etc.). For now, we will choose non-Capitalize Goods.¶

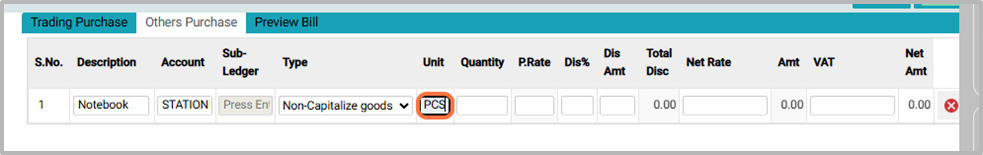

24. Choose or enter the unit of the item.for Eg: PCS¶

25. Enter the Number of quantity for the product¶

26. In the Discount field, enter the discount amount or percentage if you want to apply a discount on this product (e.g., 5).¶

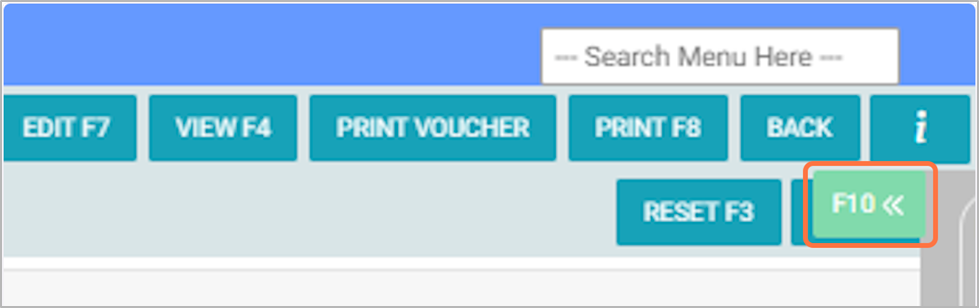

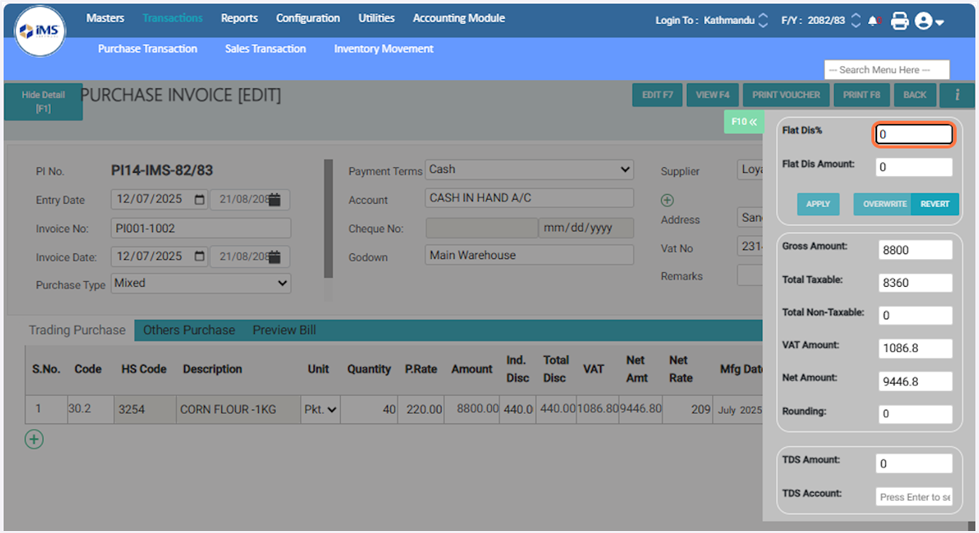

27. Press F10 to access additional features for the Mixed purchase entry¶

28.From this screen, you can enter a flat discount for the purchase voucher and select or change the TDS amount for that transaction.¶

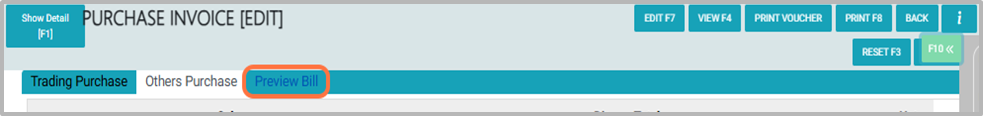

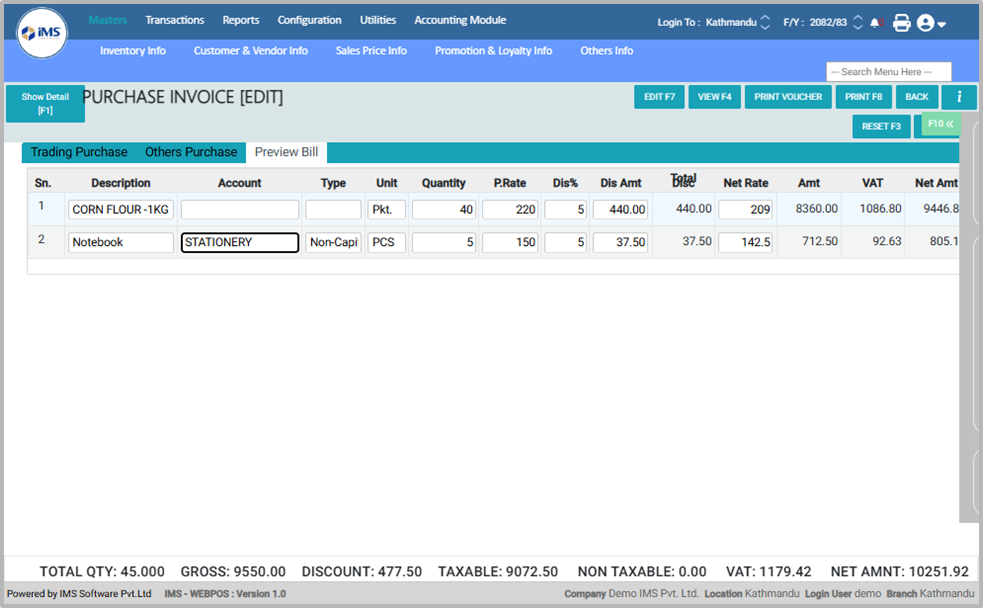

29.Click on "Preview Bill" to see the bill preview.¶

30. This screen displays a summary of the bill before finalizing the transaction.¶

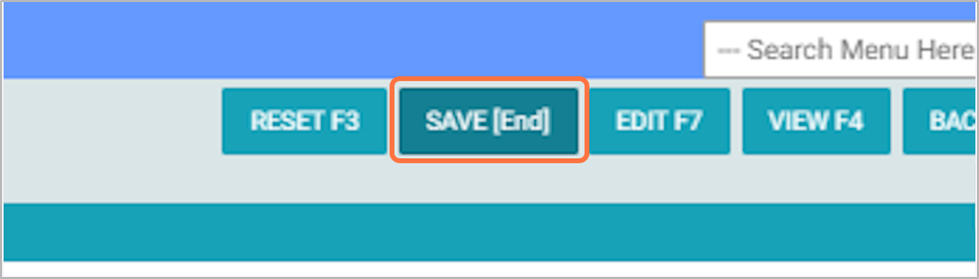

31. Click on SAVE [End]¶

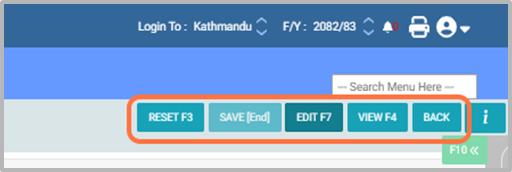

32.Buttons in Mixed Purchase Entry:

● Reset: Clears all fields so you can start a new non-trading purchase entry.

● Save: Saves the non-trading purchase entry in the system.

● Edit: Allows you to modify an existing non-trading purchase entry.

● View: Displays the details of a saved non-trading purchase without allowing edits.

● Back: Returns to the main menu or the previous screen.¶