|

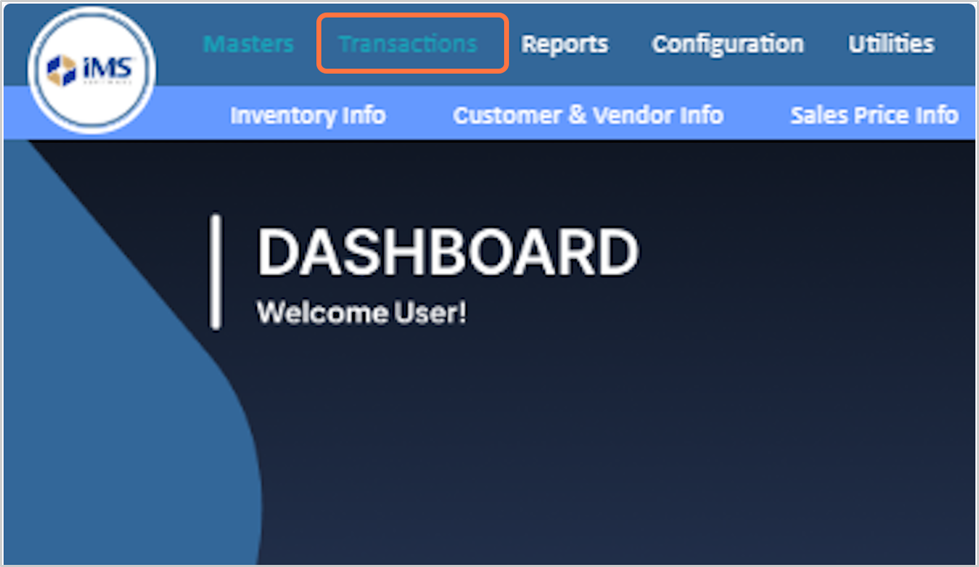

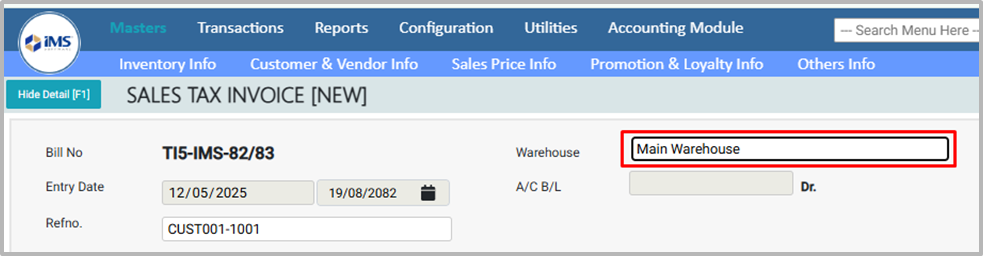

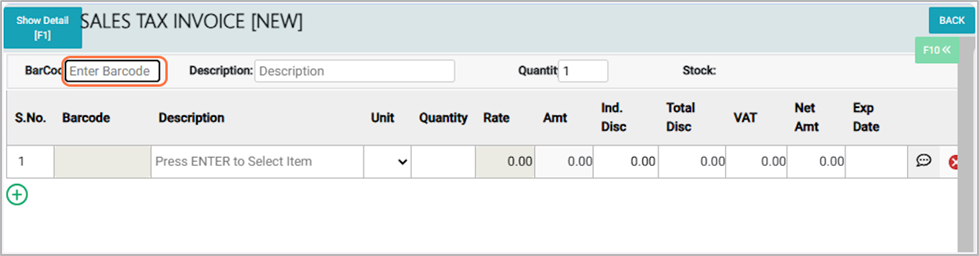

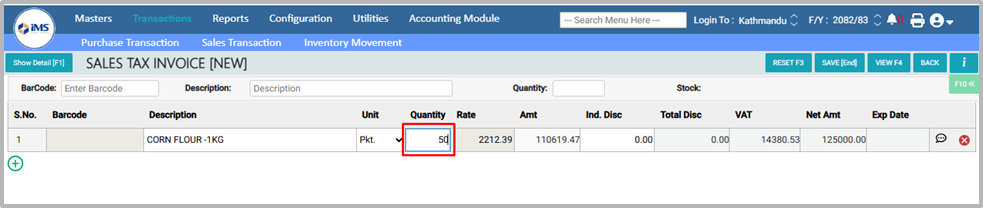

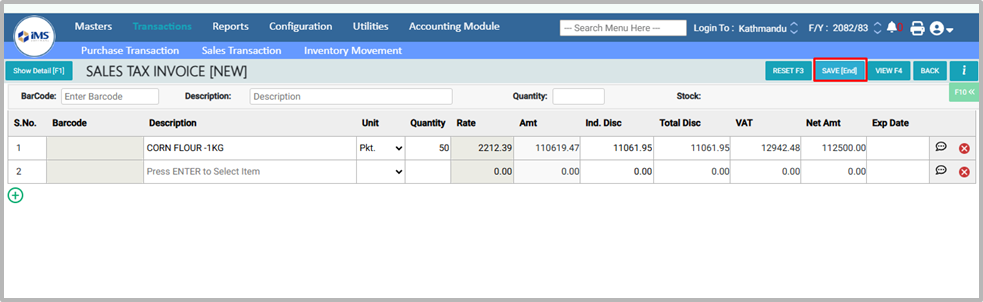

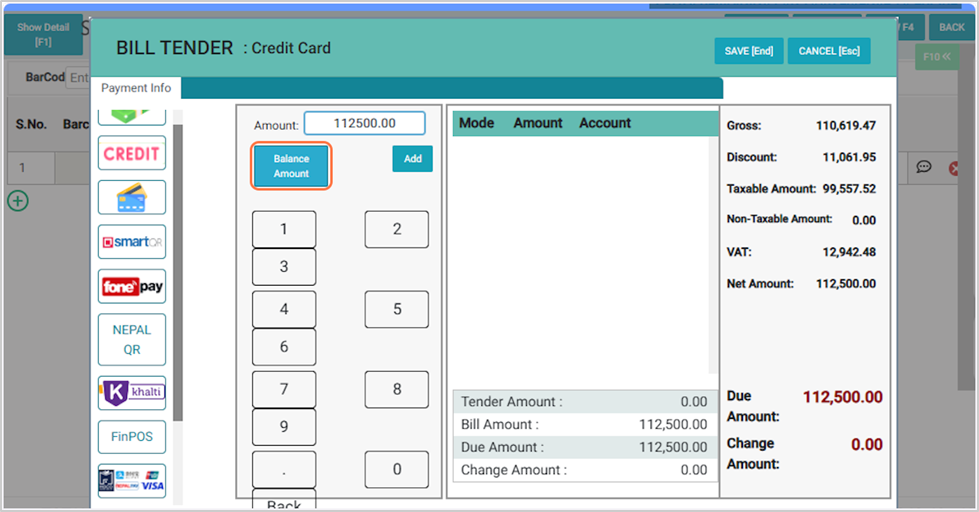

clipboard-202601081600-kqfok.png (251 KB)

clipboard-202601081600-kqfok.png |

|

Sujata Khatri, 01/08/2026 10:15 AM

|

|

|

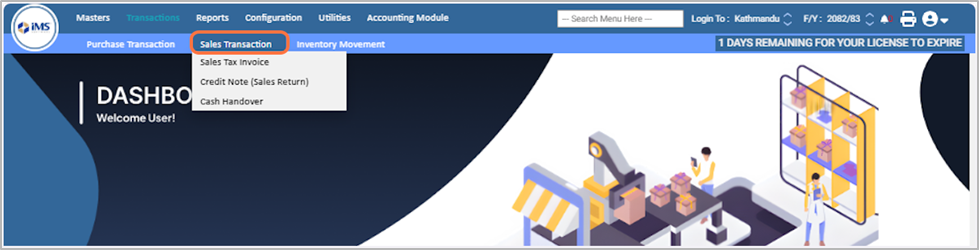

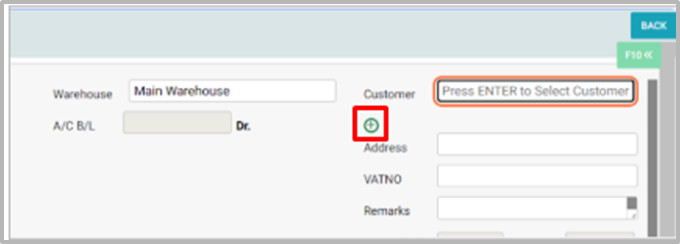

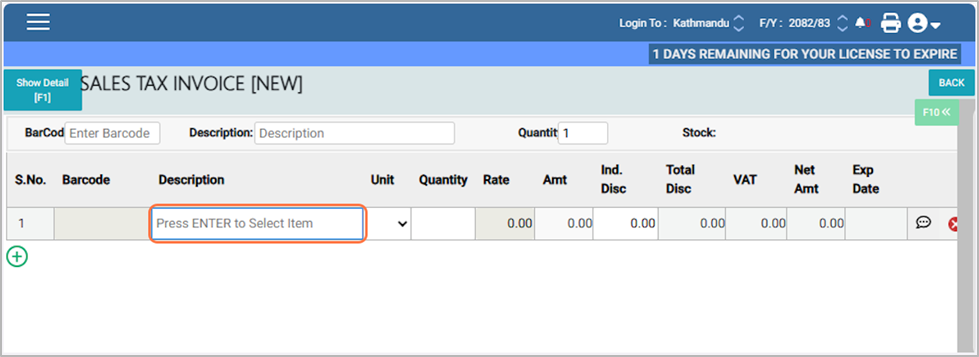

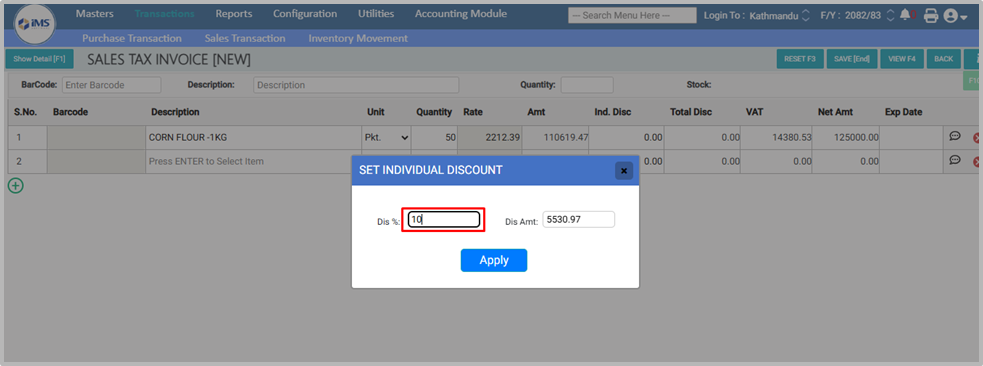

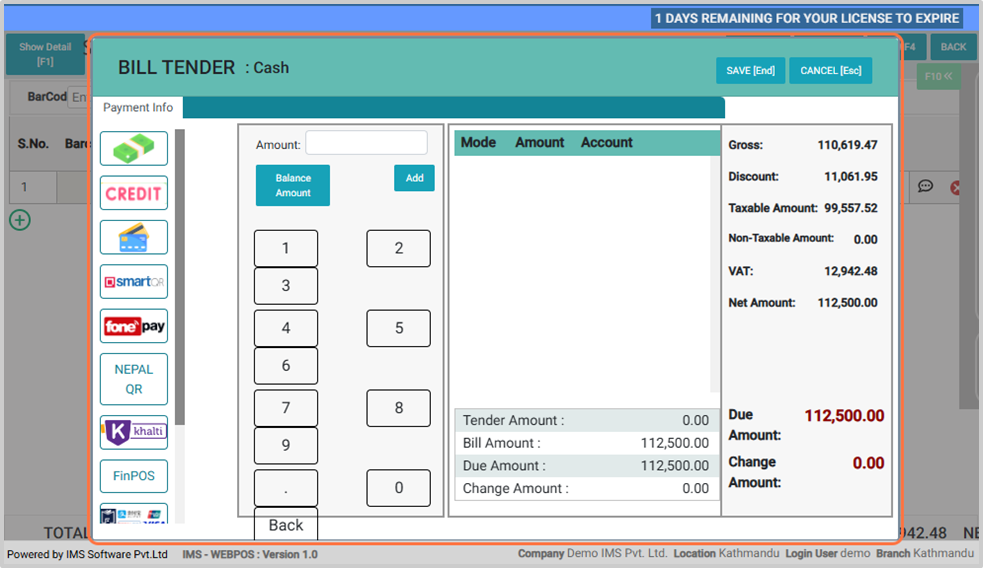

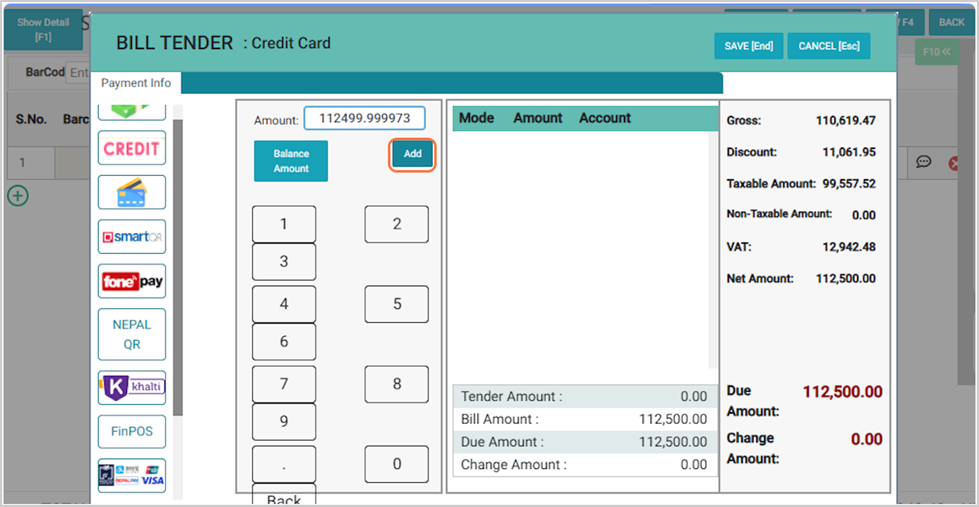

clipboard-202601081600-rpxqd.png (195 KB)

clipboard-202601081600-rpxqd.png |

|

Sujata Khatri, 01/08/2026 10:15 AM

|

|

|

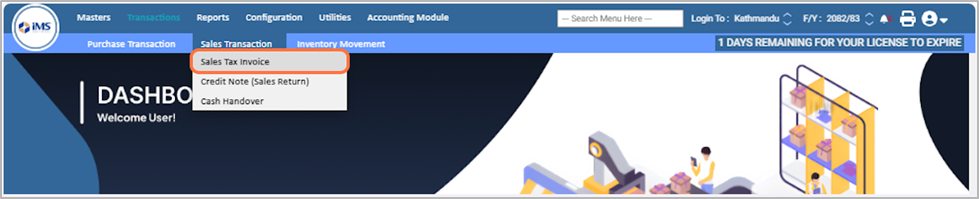

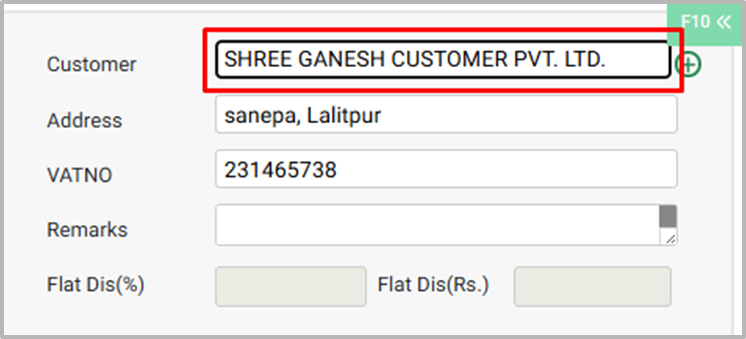

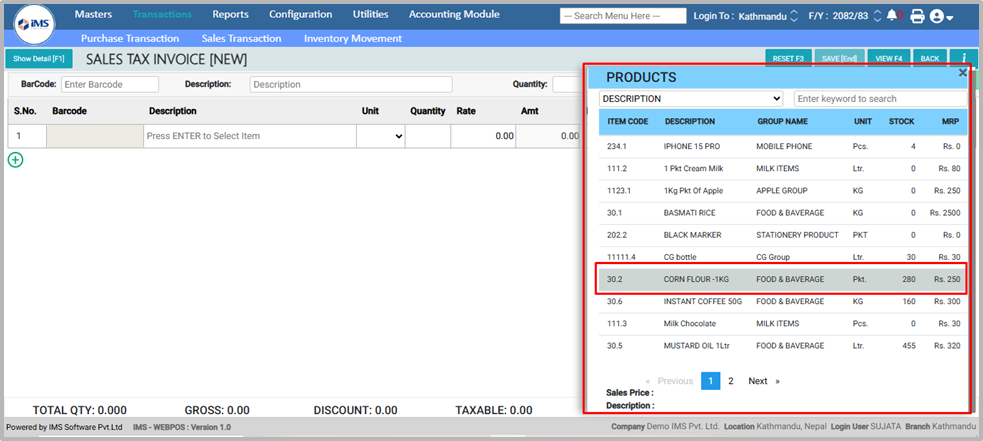

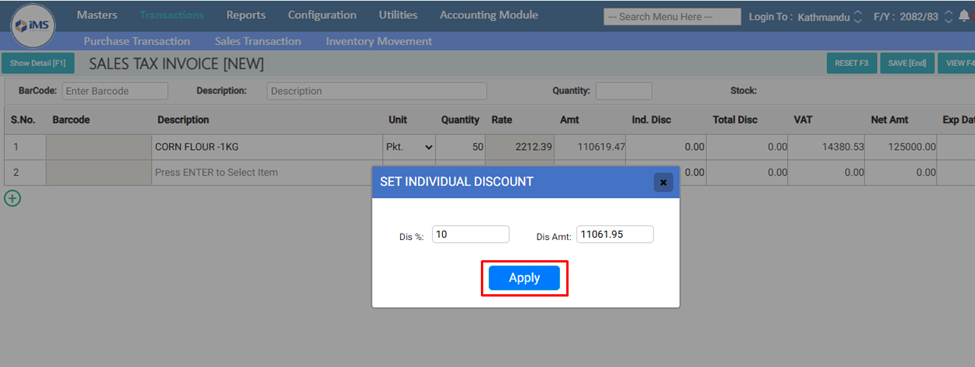

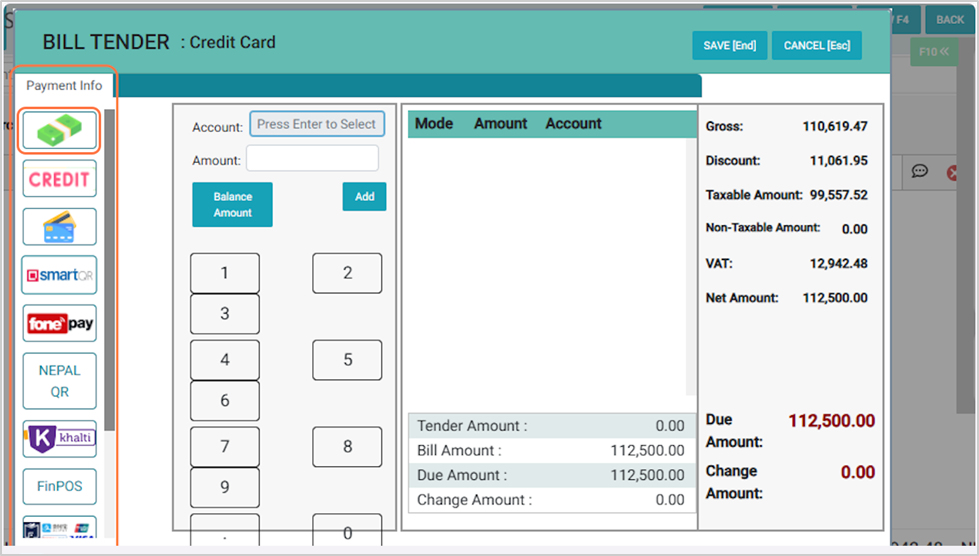

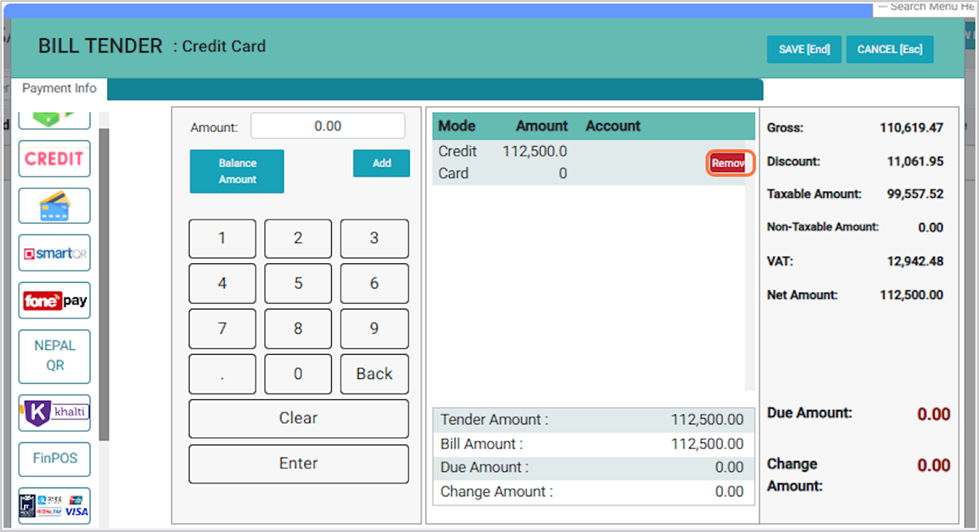

clipboard-202601081600-njmkh.png (141 KB)

clipboard-202601081600-njmkh.png |

|

Sujata Khatri, 01/08/2026 10:15 AM

|

|

|

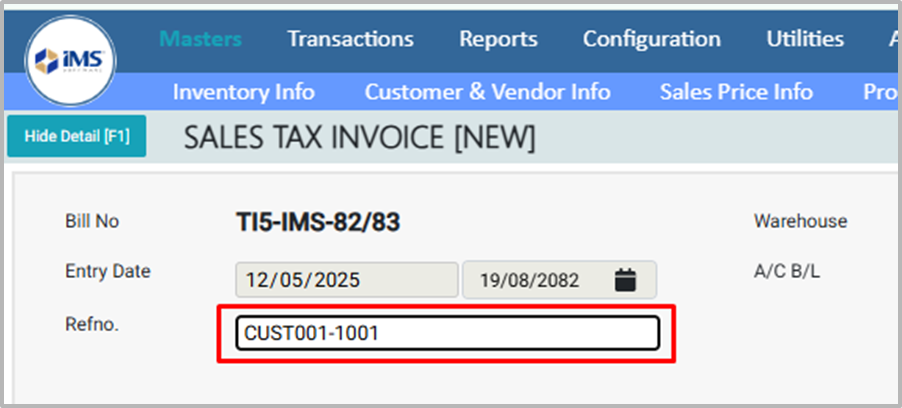

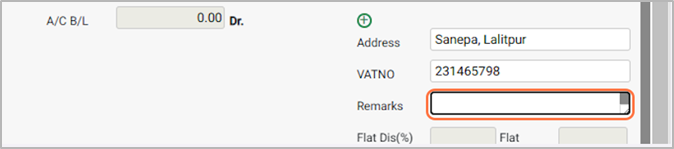

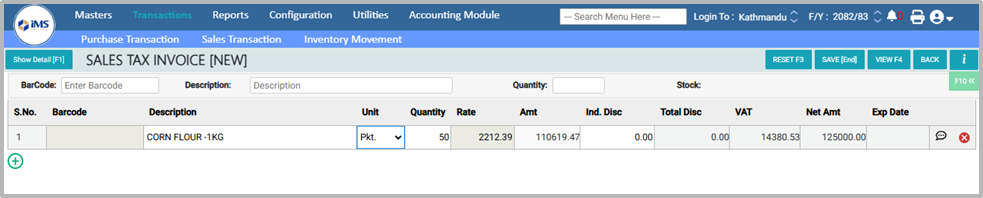

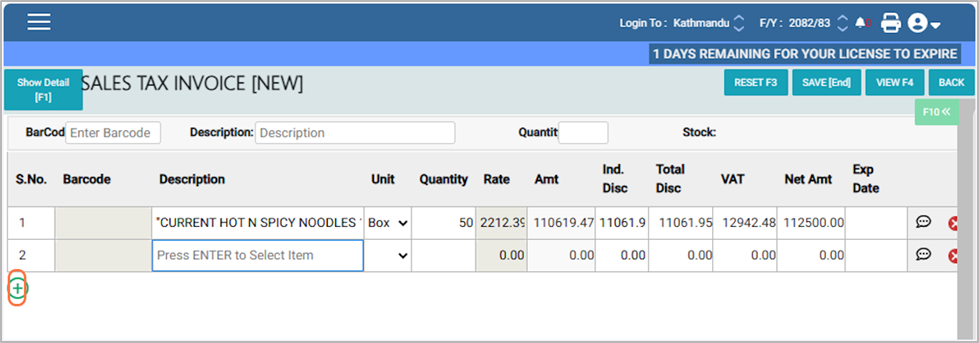

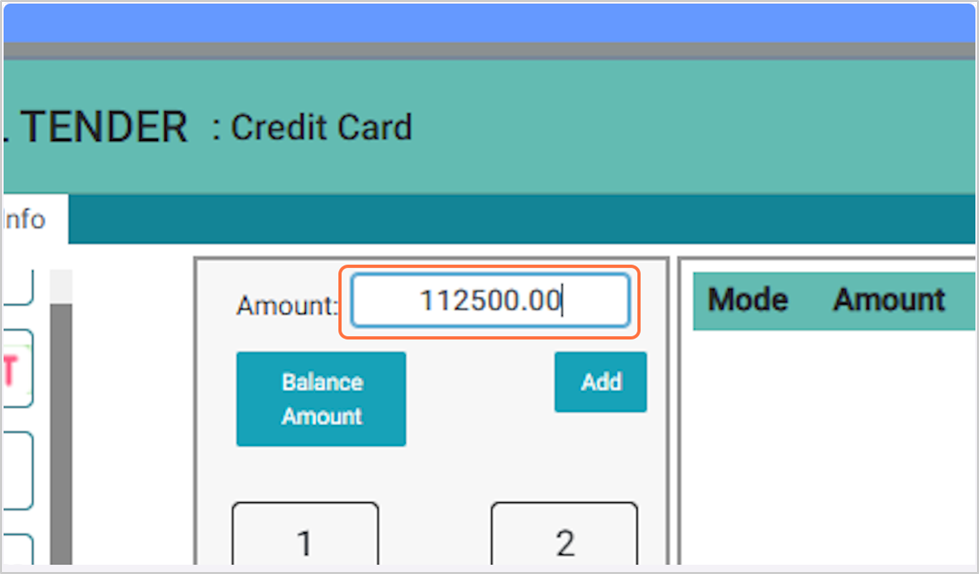

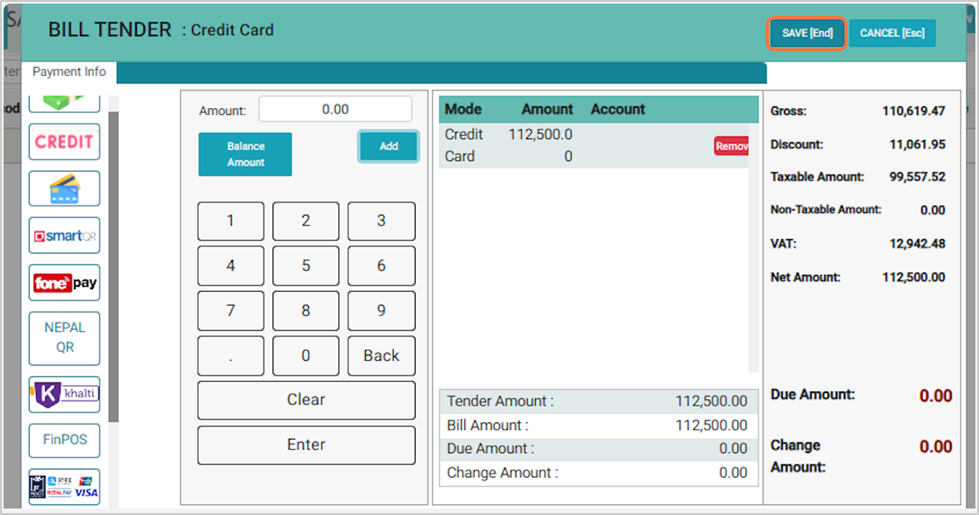

clipboard-202601081601-o0dob.png (139 KB)

clipboard-202601081601-o0dob.png |

|

Sujata Khatri, 01/08/2026 10:16 AM

|

|

|

clipboard-202601081602-aicpy.png (88.7 KB)

clipboard-202601081602-aicpy.png |

|

Sujata Khatri, 01/08/2026 10:17 AM

|

|

|

clipboard-202601081602-zmmrq.png (39.2 KB)

clipboard-202601081602-zmmrq.png |

|

Sujata Khatri, 01/08/2026 10:17 AM

|

|

|

clipboard-202601081602-09aaj.png (74.2 KB)

clipboard-202601081602-09aaj.png |

|

Sujata Khatri, 01/08/2026 10:17 AM

|

|

|

clipboard-202601081602-rullm.png (22.9 KB)

clipboard-202601081602-rullm.png |

|

Sujata Khatri, 01/08/2026 10:17 AM

|

|

|

clipboard-202601081602-nabqb.png (70.7 KB)

clipboard-202601081602-nabqb.png |

|

Sujata Khatri, 01/08/2026 10:17 AM

|

|

|

clipboard-202601081603-e01m5.png (102 KB)

clipboard-202601081603-e01m5.png |

|

Sujata Khatri, 01/08/2026 10:18 AM

|

|

|

clipboard-202601081603-uakhj.png (155 KB)

clipboard-202601081603-uakhj.png |

|

Sujata Khatri, 01/08/2026 10:18 AM

|

|

|

clipboard-202601081603-8sv2b.png (74.8 KB)

clipboard-202601081603-8sv2b.png |

|

Sujata Khatri, 01/08/2026 10:18 AM

|

|

|

clipboard-202601081603-ja5vx.png (75.3 KB)

clipboard-202601081603-ja5vx.png |

|

Sujata Khatri, 01/08/2026 10:18 AM

|

|

|

clipboard-202601081603-yqkty.png (92.9 KB)

clipboard-202601081603-yqkty.png |

|

Sujata Khatri, 01/08/2026 10:18 AM

|

|

|

clipboard-202601081604-7eyh5.png (95.3 KB)

clipboard-202601081604-7eyh5.png |

|

Sujata Khatri, 01/08/2026 10:19 AM

|

|

|

clipboard-202601081604-iyviv.png (126 KB)

clipboard-202601081604-iyviv.png |

|

Sujata Khatri, 01/08/2026 10:19 AM

|

|

|

clipboard-202601081604-xjojg.png (84.6 KB)

clipboard-202601081604-xjojg.png |

|

Sujata Khatri, 01/08/2026 10:19 AM

|

|

|

clipboard-202601081604-ynneg.png (191 KB)

clipboard-202601081604-ynneg.png |

|

Sujata Khatri, 01/08/2026 10:19 AM

|

|

|

clipboard-202601081604-twk2t.png (183 KB)

clipboard-202601081604-twk2t.png |

|

Sujata Khatri, 01/08/2026 10:19 AM

|

|

|

clipboard-202601081604-lvdcg.png (112 KB)

clipboard-202601081604-lvdcg.png |

|

Sujata Khatri, 01/08/2026 10:19 AM

|

|

|

clipboard-202601081605-abt2w.png (169 KB)

clipboard-202601081605-abt2w.png |

|

Sujata Khatri, 01/08/2026 10:20 AM

|

|

|

clipboard-202601081605-i7cq0.png (169 KB)

clipboard-202601081605-i7cq0.png |

|

Sujata Khatri, 01/08/2026 10:20 AM

|

|

|

clipboard-202601081605-9sazg.png (181 KB)

clipboard-202601081605-9sazg.png |

|

Sujata Khatri, 01/08/2026 10:20 AM

|

|

|

clipboard-202601081605-yerz6.png (179 KB)

clipboard-202601081605-yerz6.png |

|

Sujata Khatri, 01/08/2026 10:20 AM

|

|

|

clipboard-202601081605-o2fzo.png (129 KB)

clipboard-202601081605-o2fzo.png |

|

Sujata Khatri, 01/08/2026 10:20 AM

|

|

|

clipboard-202601081606-atp0j.png (172 KB)

clipboard-202601081606-atp0j.png |

|

Sujata Khatri, 01/08/2026 10:21 AM

|

|

|

clipboard-202601081606-amdvq.png (19.3 KB)

clipboard-202601081606-amdvq.png |

|

Sujata Khatri, 01/08/2026 10:21 AM

|

|