Additional Cost

User documentation

07/22/2025

Additional Cost:¶

Additional Cost is the voucher which helps to add all the additional bills which comes attached after import purchasing.

Additional bills like Insurance bill, custom service payment bill, etc.

So these additional bills are only to be posted from additional cost as it changes the final cost of the Import Purchase Bill.

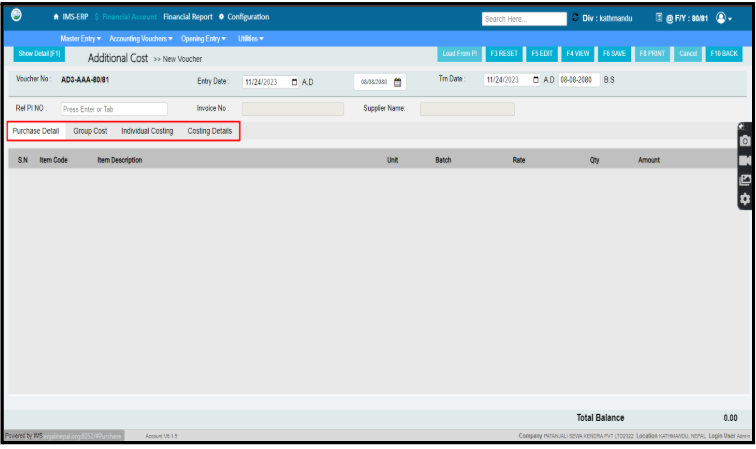

Additional Cost Voucher:¶

In the additional cost voucher we can see there are four categories:

- Purchase Detail

- Group Cost

- Individual Costing

- Costing Details

Firstly we need to enter the import purchase bill through the Purchase detail >> then we need to add the additional bills as discussed earlier in the group cost (if need to calculate qty or amt wise) or individual costing (if has own method of calculation) >> then the summarized form after adding all the bills are shown in Costing Details.

Now lets dive into details:

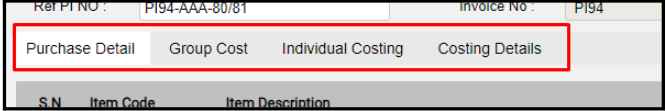

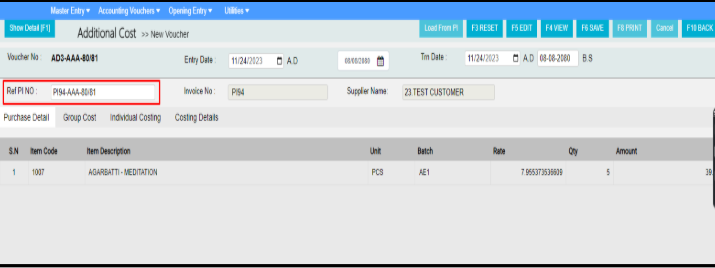

- Purchase Detail:

- In the purchase details category we need to load the purchase bill through Ref PI NO: shown in the picture above.

- We can load the ref purchase bill from the menu and the bill data will be loaded accordingly.

- We only select the bill that we need to post the additional bills for.

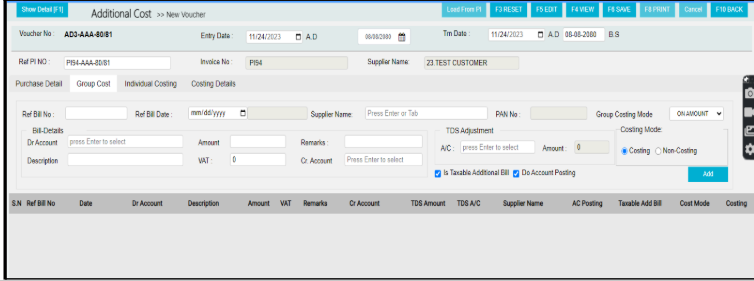

- Group Cost:

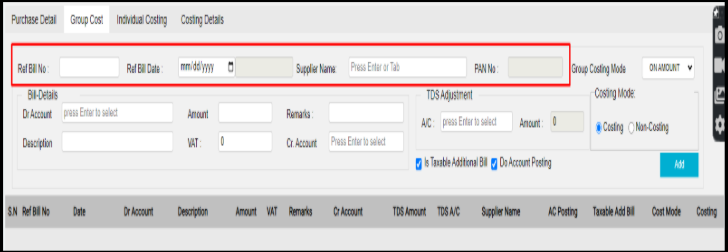

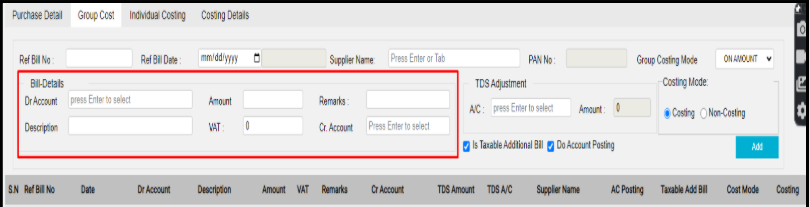

As we can see there are lots of menus and options once we enter the Group Cost menu, Lets look into each in details and assume we are adding a bill in the Group Cost:

Ref Bill No: >> Ref Bill Date: >> Supplier Name: >> PAN No:

In this fields we need to enter the data of the additional bill that we need to add. For eg:

- If we have a bill from the custom payment attached in our import purchase bill.

- We need to enter the details of that custom payment bill. Like its Bill No:, Bill Date, Supplier Name, PAN No, in those fields shown above.

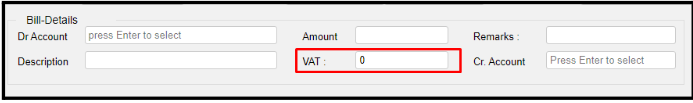

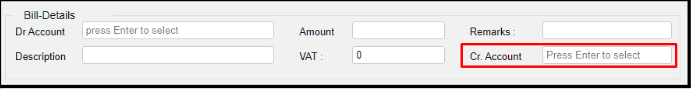

- Next Comes the Bill details fields:

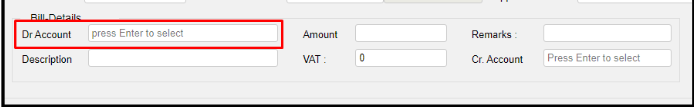

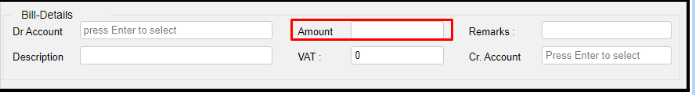

- In the Bill Details options we have:

- : Dr Amount :- In this Dr amount we need to enter the a/c from which the expenses are made. The account from which expenses is deducted for the particular bill is added in this field, for eg: custom expenses, security expenses, insurance expenses etc.

- : Amount :- In this field we need to enter the taxable amount according to the bill we are about to add.

- : VAT :- In this field we need to enter the VAT according to the bill we are about to add.

- : Cr Amount :- In this Cr Amount we need to enter the a/c to which the payment is made. The account to which the deducted amount from the Dr Amount is added (Payment).

Next comes the TDS Adjustment in the Group Cost:

- : A/C :- In this field we need to enter the account of the TDS like TDS Recievable and TDS Payable. In this case its TDS Payable most of the time.

(impt note: The TDS Adjustment deducted from the account selected is then added to the account selected in the CR Amount field in the Bill-Details)

- : AMOUNT :- In this field we need to enter the TDS amount of the respective bill

Below we can see there are two options > is Taxable Additional Bill > Do Account Posting:

- : is Taxable Additional Bill :- This is the radio button which helps to enable and disable the VAT field in the Bill Details. If the bill that we are about to add has VAT included in it we need to select the radio button and vice versa.

- : Do Account Posting :- This option is in the concept of the ledger (party ledger/account ledger). If we select the option all the accounting is posted in their respective ledgers in the report. And if we dont select it then the accounting is not posted in the ledgers and it just behaves like a reference for the one posting.

Group Costing Mode:

The Group Costing Modes help us to divide the total cost of the additional bill to be posted for every individual item available in the

There are two types of group costing modes:

: ON QTY :- If we select the ‘on qty’ option in the costing mode the whole bill we are about to post will be calculated qty ratio wise.Calculation from software:

Step 1 > Divide the qty of the item with the total qty in the bill. Answer: (we obtain a ratio)

Step 2 > Multiply the total amount of the bill we are about to post with the ration we obtain by the above calculation.

Step 3 > Finally we obtain the amount

Eg:

Item A :-

Qty of the item : 12

Total qty of the import purchase bill : 24

Total amount of the bill to be posted : 1000

Step 1 :- 12/24 = 0.5 (ratio)

Step 2 :- 1000 * 0.5 = 500

Step 3 :- 500 is the total amount according to ‘on qty’ costing mode

: ON AMOUNT :- If we select the ‘on amount’ option in the costing mode the whole bill we are about to post will be calculated amount ratio wise.Calculation from software:

Step 1: Divide the amount of the item with the total amount in the bill. Answer: (we obtain a ratio)

Step 2: Multiply the total amount of the bill we are about to post with the ration we obtain by the above calculation.

Step 3: Finally we obtain the amount

Eg:

Item A :-

Amount of the item : 7206.75

Total amount of the import purchase bill : 12085.17

Total amount of the bill to be posted : 2000

Step 1 :- 7206.75/12085.17= 0.60 (ratio)

Step 2 :- 2000 * 0.60= 1200

Step 3 :- 1200 is the total amount according to ‘on amount’ costing mode

The above mentioned methods is the only two methods given to calculated the ratio which gives us the idea on how to divide the total cost of the bill to be posted with every particular item on the bill.

Costing Mode :-

The costing mode gives the user the ability to hide or show the effects of the bill in the reports. For example after posting the additional cost the rate of the item is changed as per the additional bills added.

So this option allows us to whether apply the effects of the bill or just keep it for reference without making any changes in the overall reports.

This is developed because sometimes the expense additional bills are not legitly disbursed to the buyer. So they are not being able to claim it as an additional bills.

So in that case we can just use this mode to show or hide the effects.

There are two types of costing mode:

: Costing :- This mode is used to apply the effects and changes in the rate of the items in the import purchase bill in the reports after purchasing

: NON-COSTING :- This mode is used when we dont want to apply the changes in the rate of the items in the reports after saving the Additional Cost.