Colorant (Sales Return)

User documentation

07/10/2025

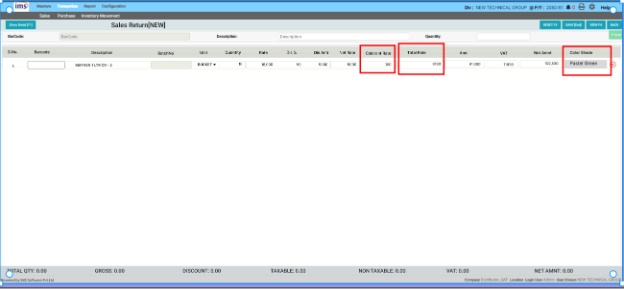

Sales Return¶

UI Design¶

Database Changes¶

- This feature should be controlled by the new Setting “EnableColorantinTaxInvoice”.

- Setting “EnableColorantinTaxInvoice” = 0

- The Colorant rate box should not be shown in the Sales Return.

- Setting “EnableColorantinTaxInvoice” = 1

- The Colourant rate box should appear.in the Sales Return (same as tax invoice).

- Setting “EnableColorantinTaxInvoice” = 0

Functional Requirement¶

- If the sales return is full then all the items and discount should be reflected as it is in the selected sales tax invoice.

But - For partial sales returns, the system should allow the selection of products from the Product Selection Box. After selecting a product and entering the quantity, the base rate should be displayed. When the user clicks on Colorant Rate, the selected colorant should be shown, allowing the user to manually enter the colorant quantity. The colorant rate(Colorant Amount / Quantity in the invoice ) should be displayed in the invoice, and the net rate should be automatically calculated.It should be applicable for multiple items too.

Limitation¶

- Manual Sales Return will not be supported in the sales return

Application Flow¶

Scenario: First Set Setting “EnableColorantinTaxInvoice” = 1 and Create a Sales Tax invoice with Colorant and then, due to some reason, return it by creating a sales return.

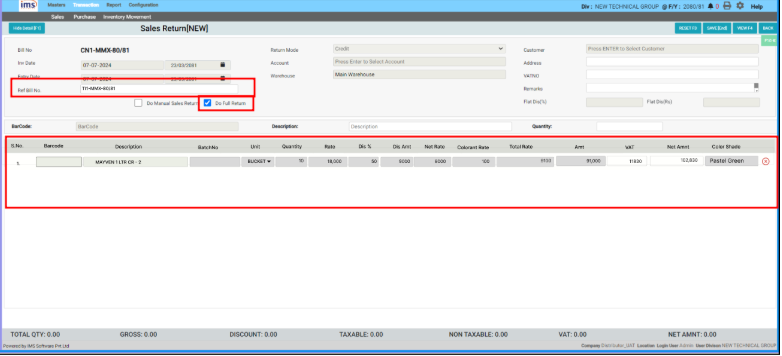

Full sales return

Step 1 : Go to the Sales Return section, click on Ref Bill No., and press Enter. This action will trigger the voucher selection box, where you can select the Sales Tax Invoice that is intended to be returned. Make sure the "Do Full Return" field is checked, which is the default setting in the system.

Scenario: After selecting the Sales Tax Invoice, all the entered data should be loaded as it is in the Sales Tax Invoice. When the user clicks on save, Base Item & Used Colorant Items have to be Return accordingly.

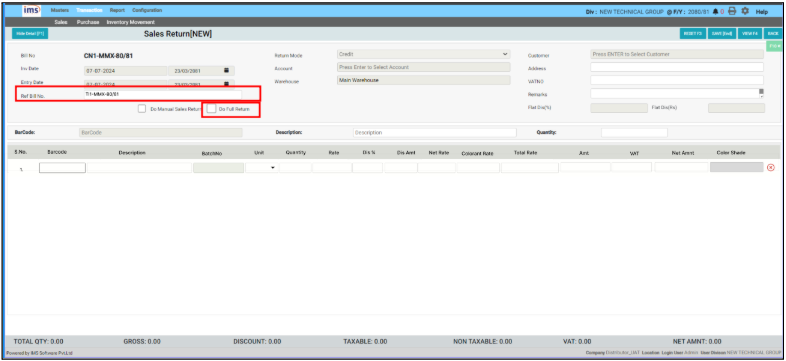

Partial sales return

Step 1 : Go to the Sales Return section, click on Ref Bill No., and press Enter. This action will trigger the voucher selection box, where you can select the Sales Tax Invoice that is intended to be returned. Make sure the "Do Full Return" field is unchecked.

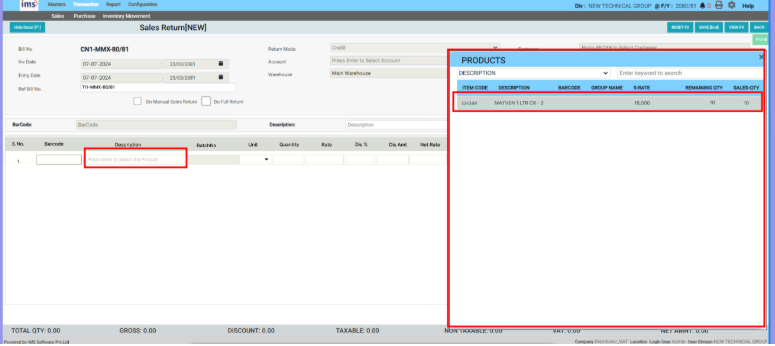

Step 2 : Press Enter to select the product, and a Product Selection Box will appear, displaying the products from the selected tax invoice along with their quantities.

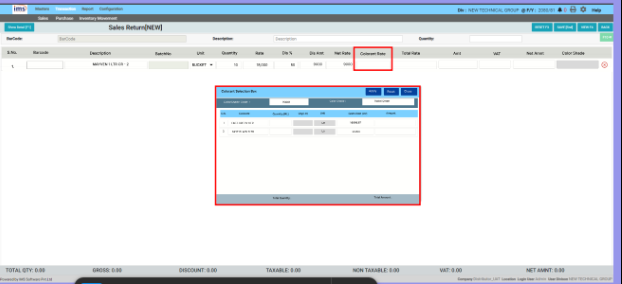

Step 3 : After selecting the product, the net rate and discount from the sales tax invoice should automatically reflect in the Sales Return Voucher. When the user clicks on the Colorant Rate field or press Tab after selecting the product, a Colorant Selection box should appear. The Colorant should be automatically filled, and the user can manually enter the quantity of the Colorant.Colorant Item Qty has to be validated.Colorant Rate has to be locked and should auto fill as per reference bill.

Step 4 : Then click on Save in the Colorant Selection Box. After clicking Save, the Colorant Rate should be calculated as (Colorant Amount / Quantity mentioned in the sales return voucher). After that, the total rate should be calculated as (Net Rate + Colorant Rate). Then, the Amount, VAT, and Net Amount should be calculated.When the user clicks on save, Base Item & Used Colorant Items have to be returned accordingly.

Note : Please check if this feature supports multiple items or not.