Foreign Currency

User documentation

07/10/2025

Foreign Currency¶

Requirement Overview¶

Foreign currency is important in forms because it ensures clarity in international transactions and helps to accurately calculate local taxes.

Database Changes¶

- Setting Enableforeigncurrency = 0 | 1

- Setting Enableforeigncurrency = 0

- Hide Currency , Exchange and FC. Rate from the Sales Tax Invoice and Credit Note form

- Hide the Multi Currency Price from the Product Master

- Setting Enableforeigncurrency = 1

- Show Currency , Exchange and FC. Rate from the Sales Tax Invoice and Credit Note form.

- Show the Multi Currency Price from the Product Master

- Setting Enableforeigncurrency = 0

Application flow¶

Step 1 : Set Setting Enableforeigncurrency = 1 in the database.- Show Currency , Exchange and FC. Rate from the Sales Tax Invoice and Credit Note form.

- Show the Multi Currency Price from the Product Master

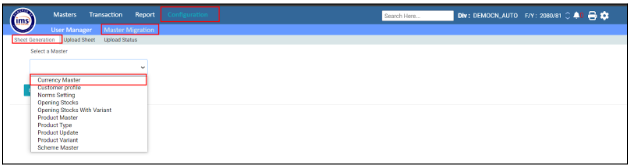

- Go to Configuration and select the Master Migration.

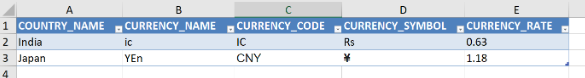

- Choose the Currency Master from the drop down and Click on Download Sample

- After filling up the sheet as per the example given in the download sample and select the Upload Sheet(Configuration >> Master Migration ).

- Choose the Currency Master from drop down and then choose the saved file. After that Click on Upload File .

- While Clicking on the Upload file, the data will be uploaded in the TBL CURRENCY table.

- If there is any error then it will be shown in the Upload Status File

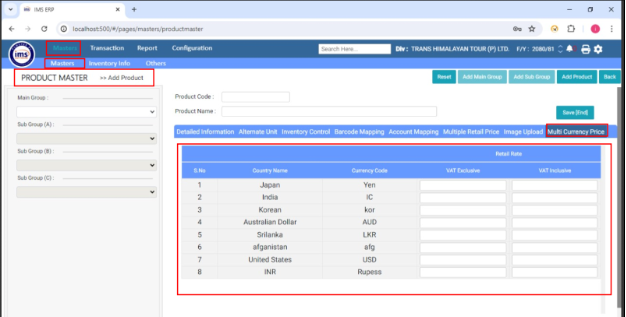

- Go to the Product Master, create a product

- Entered all the details of the product and Click on Multi Currency Price

- Set the retail price (Exclusive or Inclusive VAT price )of product as per country (The currency master data uploaded from the Master Migration will be displayed in this column)

- Then Click on Save.

- All the entered data from the product master will be saved in the MULTICURRENCYPRICE table.

Step 4 : Transaction

This feature currently affects Sales Tax Invoices and Credit Notes Only .

- Sales Tax Invoice

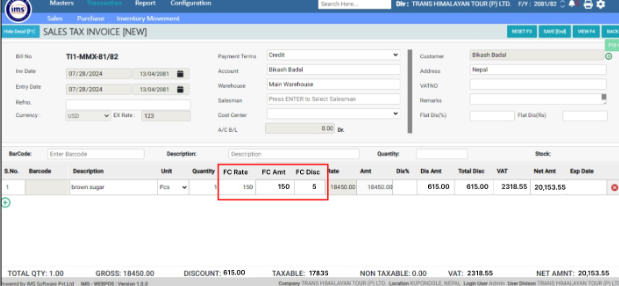

- Go to Transaction and navigate to Sales, Select the Sales Tax Invoice.

- Select the Currency From drop down and Exchange rate will automatically fill up as per imported data.

- Enter other details and When the user selects the item, the item's retail price should be shown in the FC Rate.

- FC amount should be automatically calculated as per the entered quantity and FC rate.

- When the user enters the discount then FC disc should be calculated based on the total discount divided by the Exchange Rate.ate.

- Click on Save.

- FCURRENCY table- While clicking Save , it stored the bill wise foreign currency

Note : For credit notes, the process remains the same. The only difference is that during partial or full credit notes, the foreign currency cannot be changed. However, in manual sales returns, users are allowed to change the currency.

- FCURRENCY table- While clicking Save , it stored the bill wise foreign currency

Excel Format